Bookkeeping

NY LawFund: Practical Guide to Attorney Trust Accounts andRecordkeeping

If the purchase goes forward as planned, the escrow agent will release thedown payment to the seller at the title closing. If the buyer and selleragree to cancel their contract, the escrow agent is usually required toreturn the down payment to the buyer. The length of time you should keep a document depends on the action, expense, or event the document records. Generally, you must keep your records that support an item of income or deductions on a tax return until the period of limitations for that return runs out. In addition to these general guidelines, each business should consider any industry standards which may affect the holding period of records due to the unusual legal circumstances.

Ask a Financial Professional Any Question

The cash receipts journal can be subdivided into different sections as well. For example, many companies want to know and evaluate the amount of cash they collected from sales, credit customers, and other sources. The information recorded in the cash receipt journal is used to make postings to the subsidiary ledgers and to relevant accounts in the general ledger. It is important to realize that the cash receipt journal is a book of prime entry.

What is your current financial priority?

In accounting, journals are used to record similar activities and to keep transactions organized. Because you have already received the cash at the point of sale, you can record it in your books. Again, you must record a debit in your cash receipts journal and a credit in your sales journal. Since no cash is received from credit sales transactions, they are not recorded in an accounting journal.

Do you own a business?

In the subsidiary ledger, the post reference is “CR-8”, which indicates that the entries came from page 8 of the cash receipts journal. The debit columns in a cash receipts journal will always include a cash column and, most likely, a sales discount column. Other debit columns may be used if the firm routinely engages in a particular transaction. The Lawyers’ Fund cannot settle fee disputes, or compensatefor a lawyer’s malpractice or neglect.

In this situation the line item postings to the accounts receivable ledger are for the full invoiced amount, and only the discounts allowed column total is posted to the general ledger. All cash received by a business should be reported in the accounting records. In a cash receipts journal, a debit is posted to cash in the amount of money received. Therefore, a credit is needed for one or more other accounts that are affected by collecting cash. The cash receipts journal is an important tool to keep track of cash collected by a business. Provides a chronological record of all credit sales made in the life of a business.

Cash receipts journals are key when monitoring cash flow and accounts receivable, which are two essential accounts when it comes to the success of any business. Both cash and credit sales of non-inventory or merchandise are recorded in the general journal. One of the journals is a cash receipts journal, a record of all of the cash that a business takes in. You may sell items or provide services that people pay for with cash, which may range from food or books to massages or even a ride in a taxicab. SequentiallyAccount-wiseDebit and CreditColumnsSidesNarrationMustNot necessary.BalancingNeed not to be balanced.Must be balanced. Since the cost of sales is essentially the cost of doing business, it is recorded as a business expense on the income statement.

For this reason the entries in the journal are not part of the double entry posting. The following example illustrates how a expenses in xero is written and how entries from there are posted to relevant subsidiary and general ledger accounts. The cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash that comes into the business. For recording all cash outflows, another journal known as the cash disbursements journal or cash payments journal is used. For example, the cash sale on June 1 is recorded in the cash receipts journal by first entering June 1 in the date column.

In this escrow example, the buyer is the depositor, and the seller is thebeneficiary. Because escrow agreements are legal contracts that involve important rightsand obligations, the careful consumer will consult a lawyer beforeentrusting money or property with an escrow agent. To keep your books accurate, you need to have a cash receipts procedure in place. Your cash receipts process will help you organize your total cash receipts, avoid accounting errors, and ensure you record transactions correctly.

- Cash receipt journals are not for transactions such as credit sales and debit but are meant for cash payments only.

- And, enter the cash transaction in your sales journal or accounts receivable ledger.

- An escrow agent has the legal duty to comply strictly with the terms andconditions of the escrow agreement.

- You calculate your cash receipts journal by totalling up your cash receipts from your accounts receivable account.

- You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US).

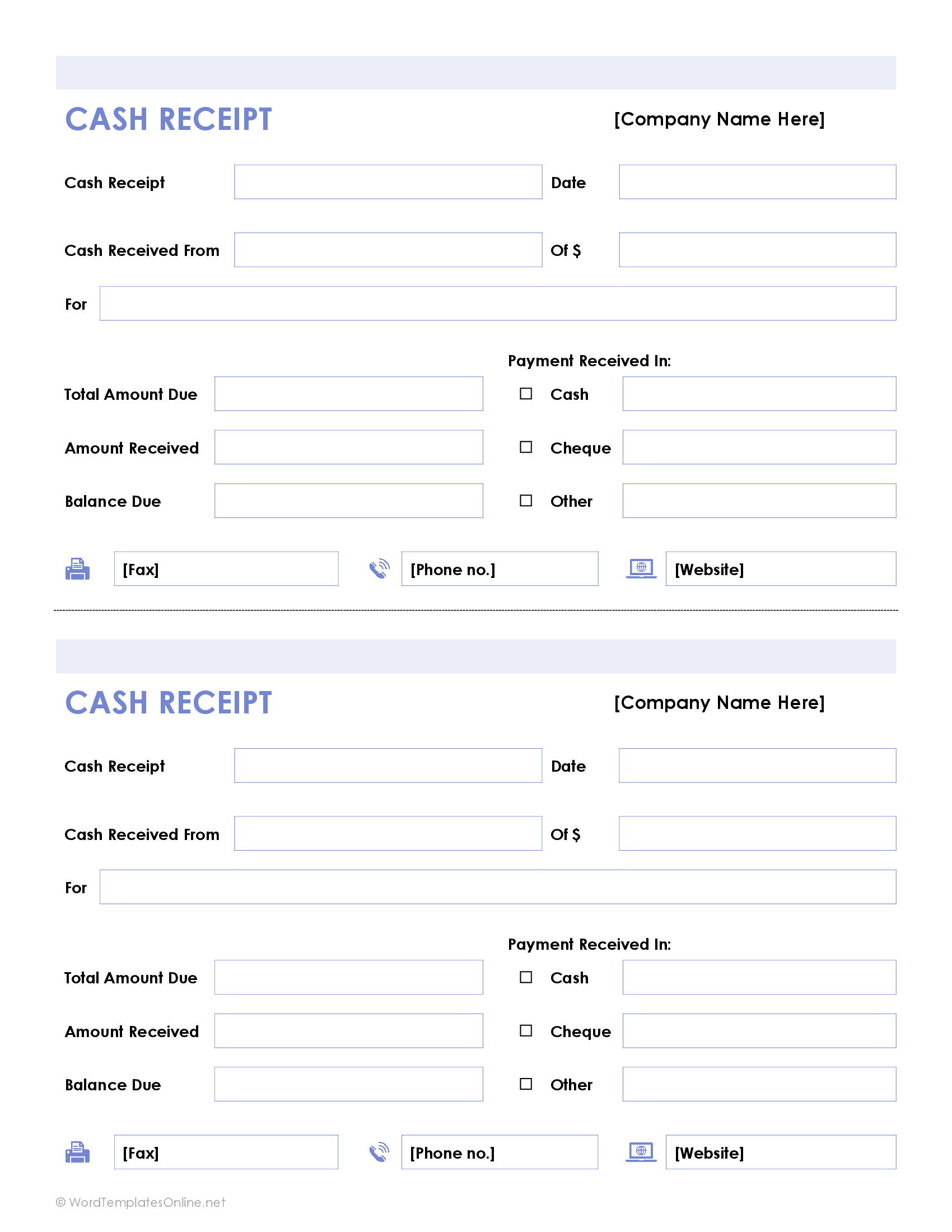

The contract frequently requires thatthe buyer’s down payment be paid to the seller’s lawyer, in escrow, or to areal estate broker, pending the title closing. In the typical escrow, the depositor is required to entrust money orproperty with an escrow agent. The escrow agent holds the escrow deposituntil it can be released to the beneficiary upon the happening of somefuture event, or the performance of some condition. Record the name of the account that is credited in the ledger as a result of the cash received. One copy of the cash receipt goes to the customer as proof of buying the product or service, while another copy stays with the business that has made the sale.

A deposit of moneywith an escrow agent should be made by certified check, for example, and notwith cash. The check should be promptly deposited in a special bank accountidentified in the escrow agreement. The depositor should review theendorsement on the check to make sure that the escrow agent has made theproper bank deposit.